Technology & Digital Transformation

Marblehead Consulting Group advises clients on new and existing technology solutions as well as exploring a comprehensive list of digital transformation initiatives currently on the minds of many C-level executives as they consider the future for transportation & logistics and its impact on their business objectives.

Additional trends and innovations we discuss:

Artificial Intelligence (AI)

Autonomous (driverless) Vehicles (AV) - Trucking

Machine learning and predictive analytics

Internet of Things (IoT)

Blockchain technology

-

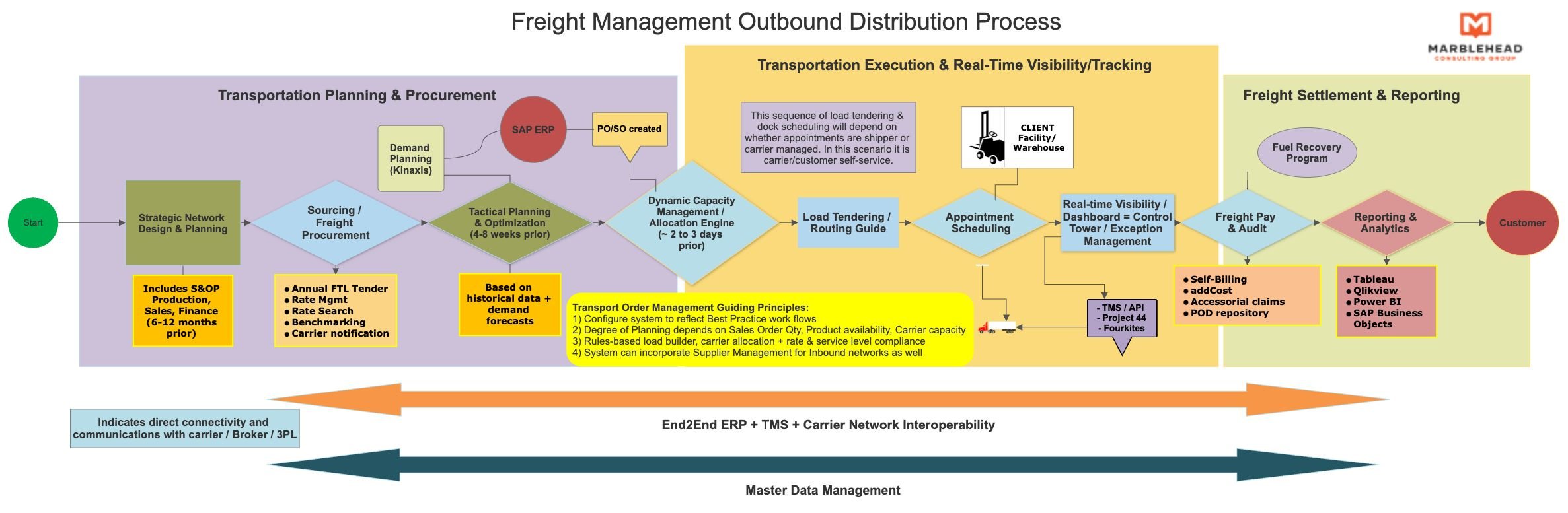

The need for a single integrated enterprise-wide operating platform. Centralized system based on a hierarchy structure (ie. branch, division, etc) for workflow standardization and best-practice adoption. Better plan and automate processes is critical to improve operational efficiency, boost productivity, improve customer service & retention, enable increased visibility for key stakeholders

Create and maintain a rules-based advanced routing guide within the TMS for carrier assignment & tendering providing greater controls around routing guide compliance based on actual bid results and carrier allocations as well as appropriate service level considerations. Also require pre-approval for “next morning by 9am”.

Improved coordination with carriers with a carrier management module for lane/equip search, compliance tools (ie. hazmat, RMIS registry). Better manage and comply with freight terms including the possibility of shifting some freight to your suppliers (ie. “delivered” terms DAP, DDU, etc.)

Active contract management & rating engine integrated with freight sourcing/procurement tools. Find the “best” carrier (combination of cost + service) across your negotiated carrier contracts and “rate shop”.

Management dashboards foster active exception management that allows users to focus specifically on what needs their attention. Integrate with carriers and real-time visibility partners (ie. p44) if only for VIP shipments or hotshots.

Today’s next generations systems architecture with microservices and advanced data structures are easily integrated through EDI, and increasingly via API, for dramatic reductions in manual collection/ sorting of information

Robust reporting on invoice accuracy, repeat offenders (carriers), recovering freight costs from customers and changes in accessorial charges from carriers. Easily manages multi-line Purchase/Sales Orders and cost allocation.

The Business Case

A TMS provides many different levers that can realize significant cost savings building a substantial return on investment. While actual returns may vary due to the unique characteristics of each business, experience has allowed us to develop some common Return on Investment (ROI) guidelines. These estimates should be helpful in determining how TMS capabilities may be able to deliver value to your business.

Values Recognized & Typical Savings Captured:

Optimized Route (7 – 28 %)

Optimized Rate/Mode (3 – 8 %)

Improve effectiveness of operations (2 – 7 %)

Control transportation centrally (2 – 9 %)

Automate settlement (3 – 5 %)

Leverage inbound/outbound across enterprise (3 – 12 %)

Utilize spot bidding, bid boards to augment contracts (7 – 18%)

-

MCG offers full support to clients procuring a TMS solution through either a formal or more infomal RFP process. It is important to first provide some context in regards to the overall TMS market and where each vendor is best positioned to play. When evaluating what type of system/solution, it is important to complete a list of critical requirements the client needs from a system. Then consider a number of additional factors that include, but are not limited to:

Explore Gartner's TMS Magic Quadrant Level 1-5 methodology to understand the "levels of network complexity" as well as the digital maturity of the client. For example Levels 1 & 2 – typically represent lower complexity networks, and therefore come at reduced one-time and recurring investment. At these levels many TMS vendors can be considered as the field is very large.

Two primary customer segments (Shipper vs Logistics Service ProvidP)

Transportation Modes - FTL, LTL, Intermodal, Ocean, Air, and Parcel

Geography - domestic focus or global enterprise

Standard package vs. Bespoke or a Hybrid version

-

Network Design, Planning and Optimization tools are used to evaluate a logistics network by diagnosing system-wide supply chain requirements from a total-cost perspective, capturing consolidation effects and network efficiency wherever possible.

TMS platforms are commonly used for transportation execution, however more sophisticated systems are also integrated with advanced “Planning & Optimization” tools to evaluate optimal routings by diagnosing system-wide supply chain requirements and constraints, and capturing consolidation effects and network efficiencies wherever possible. These optimal orders and routes are then sent to the TMS for carrier assignment and load tender to load execution.

Through more advanced planning and optimization capabilities, identify opportunities for more consolidation, merge-in-transit, parcel zone-skipping, pooling, etc.

-

With a procurement tool our clients can easily and efficiently execute freight RFPs. These tools manage the entire process from bid set-up through to carrier allocations and awards. We utilize ”best-practice” bid sheets or rate cards to simplify the rate structure and reduce the amount of accessorials, which can later negatively impact the freight audit process. We can incorporate industry benchmarking tools (ie. Freightos, Xeneta, DAT, etc.) for current market comparisons. Best-in-class tools also have rate management (for adjustments between major bids)

This typically leads to a much more sustainable transportation sourcing solution with the ability to compare multiple service levels, transport options and modes. Work with pricing at the lane level including historical shipments/volumes, as well as current benchmark rates If not executed properly this can lead to incorrect carrier selection due to inaccurate comparisons and varying pricing structures of individual carriers

Tools also have the ability to provide specific and actionable feedback to carriers (both quantitative and qualitative) at the lane level regarding their performance from bid round to bid round. Clients can run extensive scenarios/sensitivities (what if’s?) between rounds. Carriers will naturally price more aggressively on those lanes they are better at. This will ultimately drive the best bid outcome and carrier allocation from the RFP process.

Freight procurement combined with active freight cost management (TMS) are key tools in leveraging a competitive advantage and form the foundation of strategic carrier relationships.

-

Assist carriers and shippers with private fleets to efficiently manage assets by increasing utilization as well as improving service levels. Evaluate fleet systems to reduce the risk associated with investment in vehicles or equipment and offer improved visibility, tracking, driver management, dispatch, and payroll. Other topics include fleet and driver safety, fuel card and toll fee management. Automated payroll and settlement.

There are a handful of systems (FMS+TMS) that provide a fleet management and TMS combination for a complete “one-stop-shop” enterprise platform.

-

Tactical “planning” teams that are product specific and cross functional typically lead to a much more sustainable Logistics program with improved margins and the ability to provide more “guarantees” and predictability to carriers. Be more proactive vs reactive! Understand product margins, determine which products can absorb higher pricing. Add margin to certain products/ orders with higher demand variability and delivery date uncertainty, (ie. job sites) Operate cross-functionally to change buying and planning behaviors. Accelerating timelines and planning impacts capacity availability and rates. Better allocation of inventory across an integrated network. Advanced analytics combined with decision-support tools

All of this together can create better collaboration across the supply chain, from marketing promotions, production planning, and purchasing functions, to distribution and delivery - more holistic decision-making

-

Support clients in implementing an appointment scheduling solution for both inbound and outbound shipments/loads, specific to each facility. Become the Shipper of Choice for carriers!

Self-service application for drivers (mobile), carriers, customers and suppliers to book and update appointments based on client’s published facility/plant dock & yard schedules. Bring full visibility to CPUs, dropped containers, preloads, etc.

Capture meaningful KPIs to help enforce carrier compliance and reduce/eliminate ”no shows”. Typically leads to improved dock/whse mgmt. and increased hours of operation with predictable staffing (ie. do we need another shift, overtime, etc?)

Get overall visibility on dock efficiency according to the major milestones – carrier arrived, loading started, loading finished, carrier departed. Develop benchmarks, scorecards, and baselines at facilities across your entire network